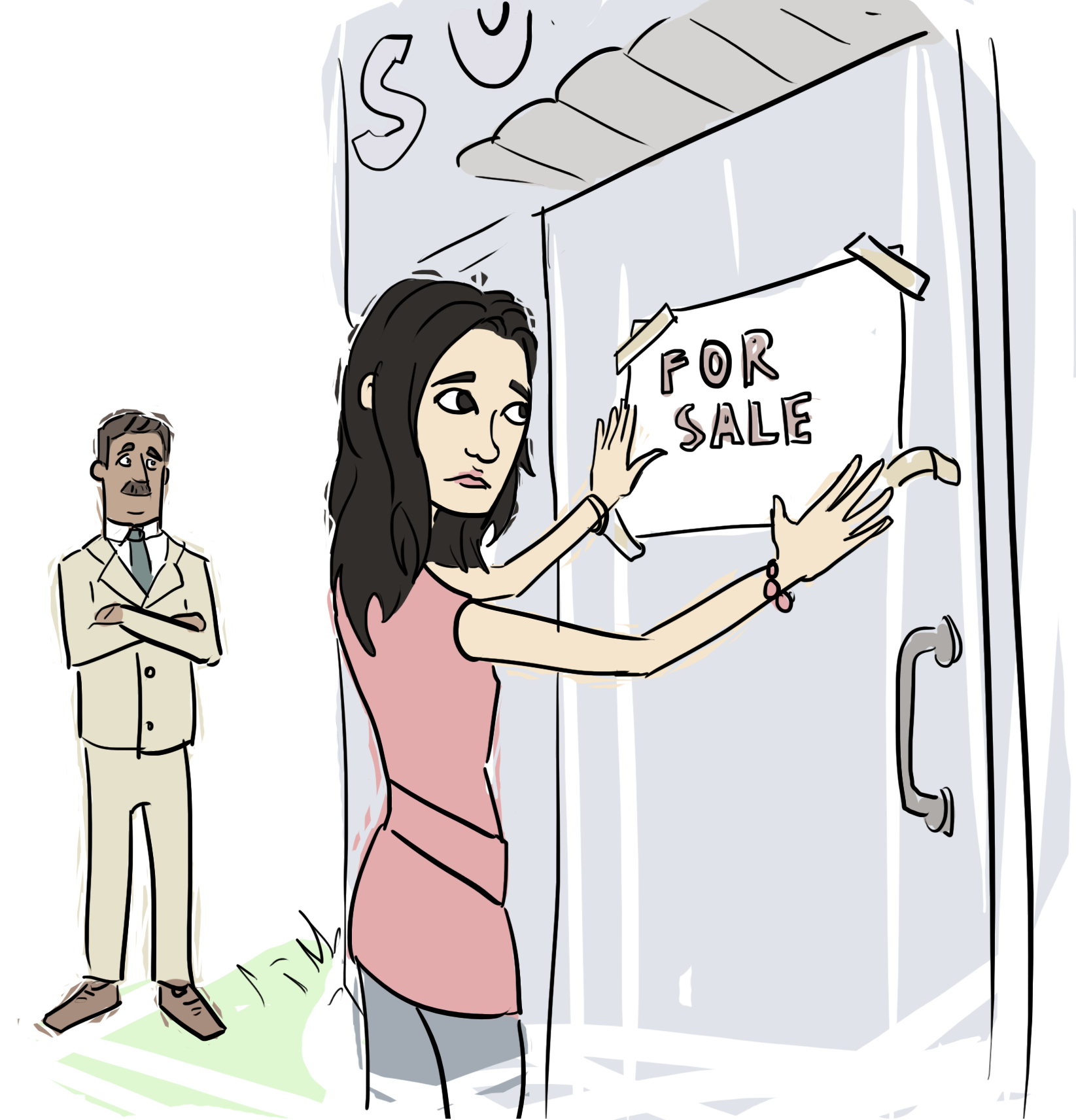

Landing an investor is always exciting. Maybe you were running on fumes, only weeks away from missing a payroll, and now you can keep pressing forward. Or maybe you just nailed your customer acquisition model and this investment will allow you to really take off. Without a doubt, a capital infusion can open doors and create new possibilities. But there is one important fact you need to know before you take an investor’s money – the day you cash the check is the day you commit to selling your business. Whether the buyer is a private company or the public markets, the reason an investor buys a piece of your company is that she thinks she can sell it for a lot more down the road. Investors can only cash out when you sell the business.

What’s more, high return requirements can put investors and entrepreneurs at odds. In extreme cases, entrepreneurs have been offered deals that would have made them millionaires, yet their investors refused to sell, holding out for a higher offer that never came.

Take on an investor only if you’re comfortable with the fact that you will have to sell your company. And, when that day comes, realize that your vote won’t be the only one that matters.