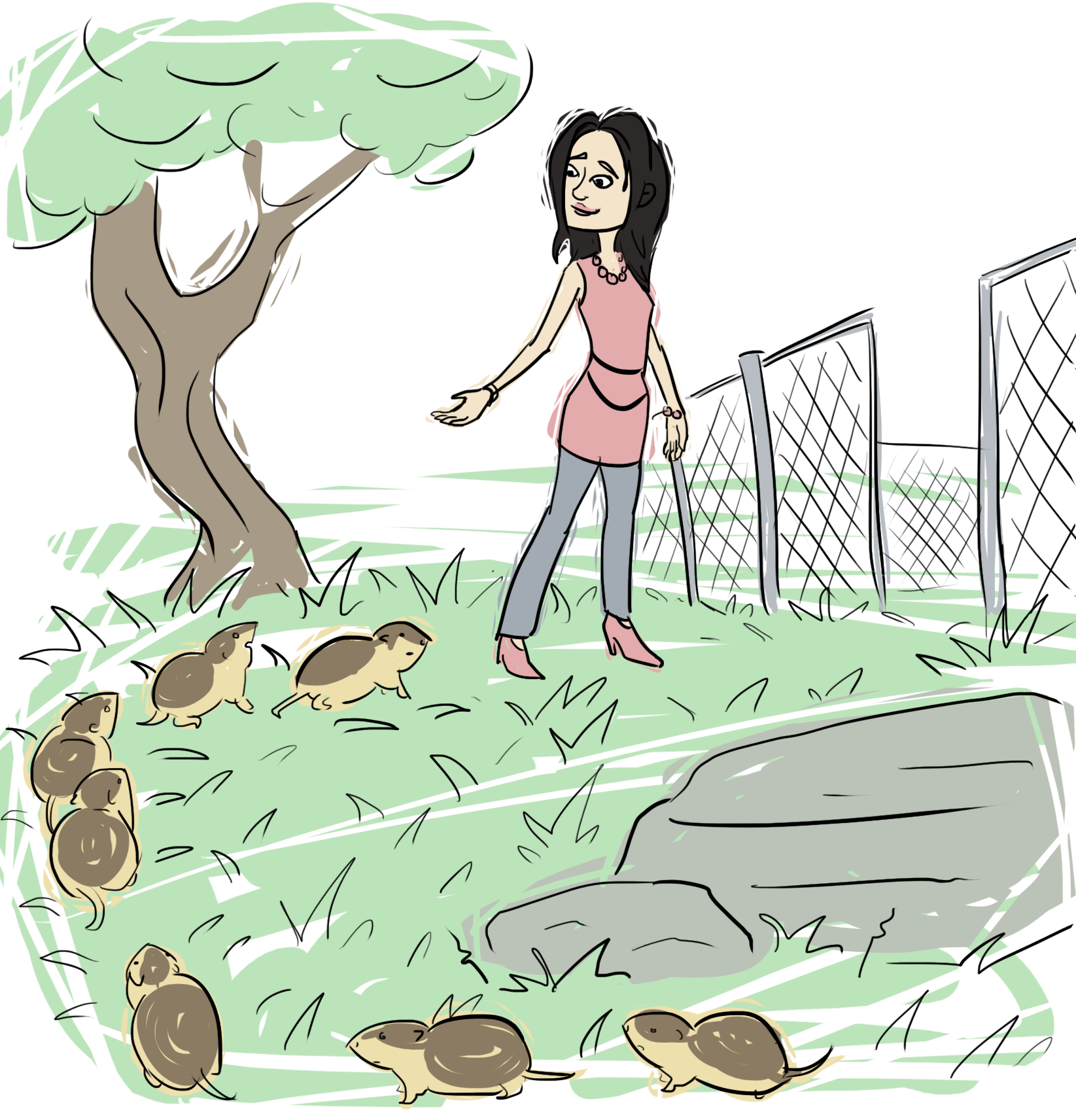

Investors are often compared to lemmings, and for good reason. Lemmings move together in groups, and blindly follow each other. Investors also feel most comfortable in packs and follow other investors. To raise capital from multiple investors, you need to find a leader among the lemmings. Otherwise, you’ll have a lot of conversations, and maybe even get a few soft commitments, but no one will write a check. The trouble is that most investors won’t tell you “no” outright, so you need a way to tell if they’re serious. If you find yourself in this situation, focus your efforts on securing a lead investor who will show the other lemmings the way. A lead investor will offer you terms that you can take to other investors. You can take the term sheet to the followers and say, “Here’s the deal – take it or leave it.” Without a lead, you’ll feel like you’re spinning your wheels.

If you can’t get an investor to step up and take the lead, try sweetening the deal for them by offering extra incentives such as warrant coverage or bonus stock.