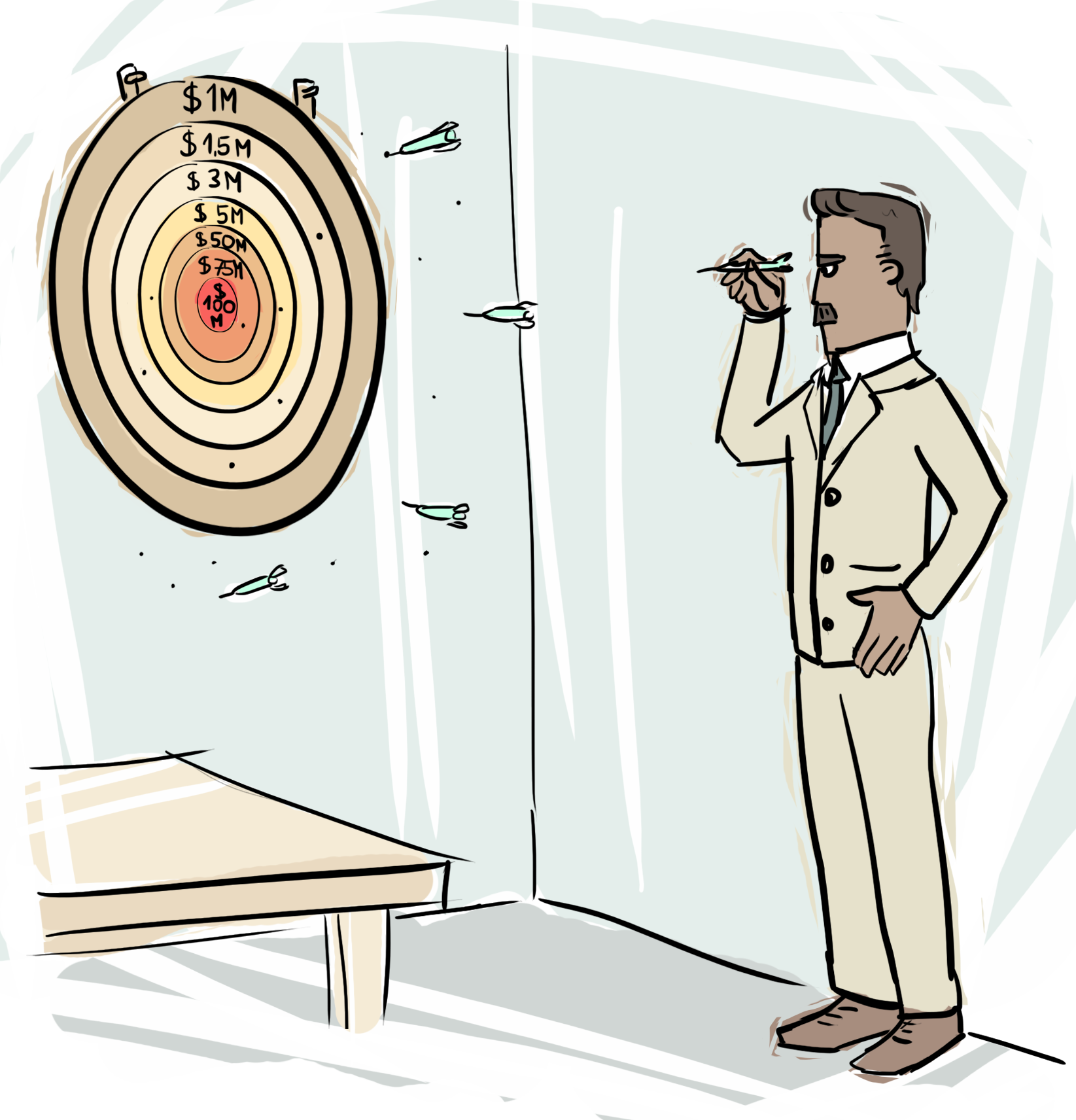

“What’s my company worth?” This is one of an entrepreneur’s most frequently asked questions. It’s also one of the hardest to answer. It is possible to value a company with a fancy financial model (e.g., Discounted Cash Flow), but the valuation will be based on projections that are little more than WAGs – Wild Ass Guesses. The dirty little secret is that, regardless of how sophisticated your model is, it’s impossible to say exactly what an early-stage company is worth. This is especially true with pre-revenue companies. In fact, valuation is so tricky that most seed stage investors prefer convertible debt because it postpones the value question until the next round of financing. In the end, your company is worth whatever someone is willing to pay.

That being said, there are a few rules of thumb that should help you get to a ballpark estimate. Valuations of seed-stage investments are usually in the $1.2-$1.8 million range. VCs typically want to own 20-40% of a company in exchange for a $2-$10 million investment. To calculate the valuations of established companies with sales and profits, valuations are normally in the range of 2-3 times sales or 8-10 times profit.

If you really need an expert opinion, there are professionals who specialize in early-stage valuations and can give you an “official” estimate of your company’s worth.